What does the

Changeover mean to you?

If your business accepts credit cards in person, and you do NOT have an EMV terminal, all liability has shifted to your business. Previously it has fallen on the issuing bank.

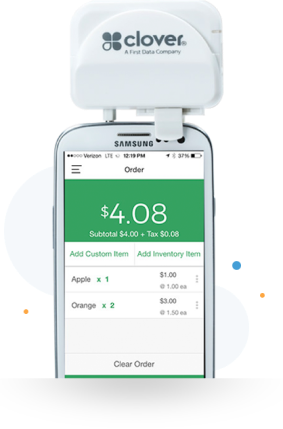

Point of Sale Systems

Point of Sale Systems

Get in touch with Sales

Get in touch with Sales